Dividend Policy

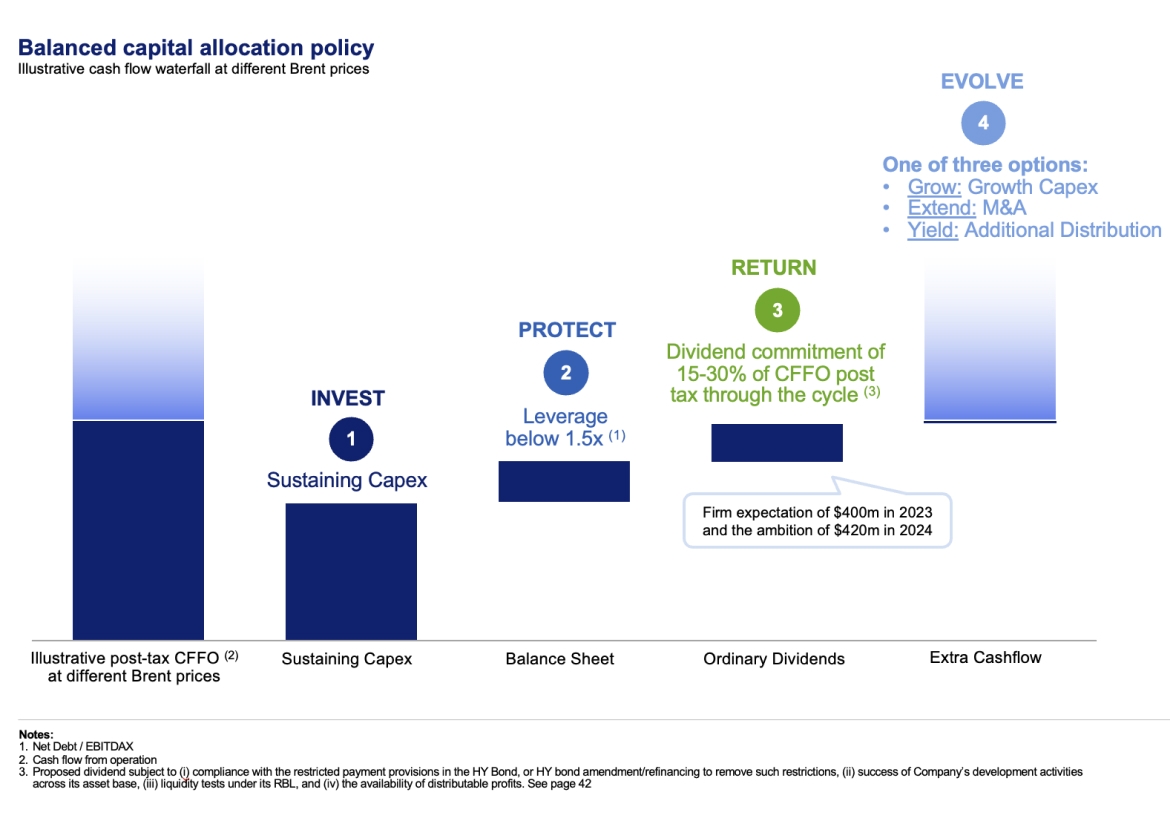

Ithaca Energy’s dividend policy is targeting annualised dividends of 15-30% of post-tax net cash from operating activities. Our dividend policy has been formulated as a range of post-tax CFFO, in order to provide visibility to investors, while granting the Company the necessary flexibility to efficiently allocate its capital and maximise value generation across its portfolio, as it simultaneously delivers attractive, sustainable returns to shareholders.

In the near-term, the Company has stated a firm expectation to pay a dividend of $400m in 2023, and an ambition to grow the dividend to $420m in 2024.

The outlined capital allocation framework includes the potential for excess cash flow to be returned to shareholders, which could be pursued via mechanisms such as additional distributions.